- May 12, 2016

Alior Bank’s Q1 2016 Results

Net of the tax on assets of financial institutions, the consolidated net profit of the Alior Bank Group was PLN 101 million in Q1 2016, up by 10 percent year on year. The net profit of the Group after the tax on assets was PLN 80 million.

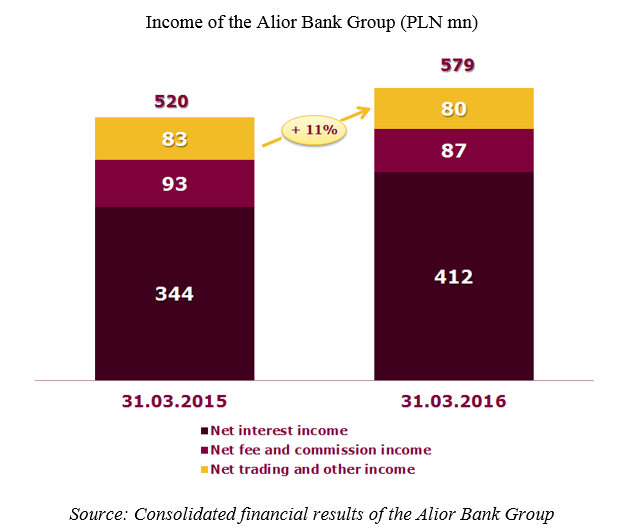

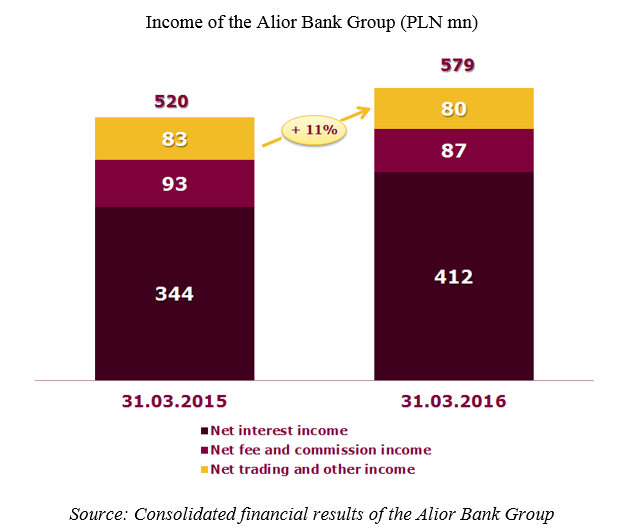

• The Alior Bank Group’s net operating income was PLN 579 million in Q1 2016, including PLN 412 million of net interest income and PLN 87 million of net fee and commission income. The net income increased by 11 percent year on year.

• The volume of new loans granted by the bank in Q1 was higher than in Q4 of the preceding year for the first time in history.

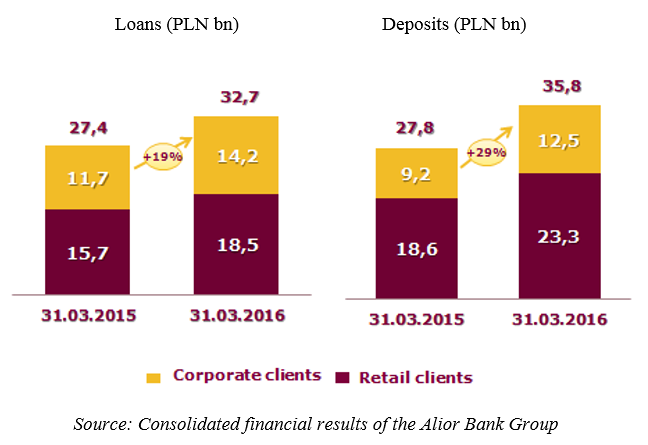

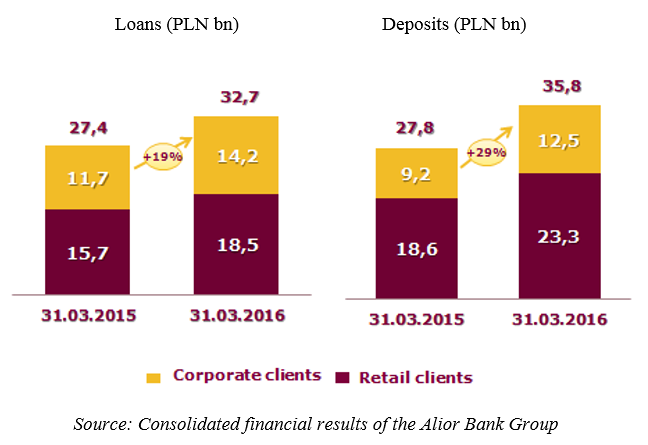

• Total loans granted to clients by the Alior Bank Group stood at PLN 32.7 billion and accepted deposits at PLN 35.8 billion at the end of March 2016. This represents an increase of 19 percent and 29 percent, respectively, year on year. The loan-to-deposit ratio was 91 percent.

• Alior Bank steadily improves its cost efficiency and grows the size of its business. The cost/income ratio (C/I) was 47.8 percent in Q1 2016.

• The capital adequacy ratios improved to 13.5 percent (CAR) and 10.6 percent (Tier 1) at the end of Q1 2016.

• On 31 March 2016, Alior Bank signed an agreement with the GE Capital Group to acquire a part of Bank BPH excluding the mortgage loan portfolio and BPH TFI. The deal is expected to be closed later in 2016. It will provide significant synergies enabling further improvement of the bank’s efficiency.

“The dynamic growth of volumes provides a robust foundation for improved profitability,” said Wojciech Sobieraj, President of Alior Bank. “In Q1 2016, our focus was to strengthen the market position, improve efficiency and sign the agreement to acquire a part of Bank BPH. We expect that the deal will be closed in Q4 2016 when all regulatory approvals are in place,” added Mr Sobieraj.

The total operating income of the Alior Bank Group stood at PLN 579 million in Q1 2016, up by 11 percent year on year. With the growing loan volumes, the net interest income grew by 20 percent to PLN 412 million. The net fee and commission income stood at PLN 87 million and the net trading and other income at PLN 80 million.

The Group is steadily improving its cost efficiency. The cost/income ratio (C/I) was 47.8 percent at the end of Q1 2016 (down by 1.9 percentage points year on year).

The volume of new loans granted by Alior Bank in Q1 was higher than in Q4 of the preceding year for the first time in history (up by 20 percent).

Loans granted to clients by the Alior Bank Group increased by 19 percent YoY to PLN 32.7 billion at the end of Q1 2016 while the volume of accepted deposits was PLN 35.8 billion, up by 29 percent year on year.

Alior Bank strengthened its capital base with an insurance bond granted by PZU on 31 March 2016 for a selected portfolio of the Bank’s credit debt, as well as two successful public issues of subordinated bonds worth PLN 220 million in aggregate. The capital adequacy ratios improved to 13.5 percent (CAR) and 10.6 percent (Tier 1) at the end of Q1 2016.

On 31 March 2016, Alior Bank signed an agreement with the GE Capital Group to acquire a part of Bank BPH excluding the mortgage loan portfolio and BPH TFI. Alior Bank is planning to raise money for the acquisition by issuing PLN 2.2 billion of stock with subscription rights of the existing shareholders. The prospectus has been submitted to the Polish Financial Supervision Authority (KNF) and the bank’s General Meeting has approved the stock issue programme. The acquisition of the core business of Bank BPH is conditional among others on the approval of the competent competition authority, as well as approvals and decisions of the Polish Financial Supervision Authority. The deal is expected to be closed later in 2016. It will provide significant synergies enabling further improvement of the bank’s efficiency. The combined assets of Alior Bank and Bank BPH will be ca. PLN 55 billion, ranking Alior Bank #9 in the Polish banking sector, as at 31 December 2015.

In Q1 2016, only five months after signing an agreement with the Romanian telecom operator Telekom Romania Mobile Communications, a member of the Deutsche Telekom Group, the National Bank of Romania registered Alior Bank’s branch as a foreign credit institution. This is an important step in continued development of the partnership and the first step of the bank’s international expansion. The Bank has been building up its partnership with T-Mobile on the Polish market as well.

Alior Bank is one of the fastest growing banks in Poland. Its assets stand at PLN 42 billion, ranking the bank #11 of Poland’s top banks by total assets at YE 2015. Nearly 3.1 million clients, including over 130 thousand companies, use the efficient service provided by more than 6,500 employees in the fourth biggest banking distribution network comprised of 831 outlets. Selected products and services of Alior Bank are offered in 583 T-Mobile points of sale under the companies’ strategic partnership, and in 71 Tesco stores. Since 2014, Alior Bank stock participates in the WIG20 index of the biggest and most liquid stocks listed on the Warsaw Stock Exchange (GPW).

• The volume of new loans granted by the bank in Q1 was higher than in Q4 of the preceding year for the first time in history.

• Total loans granted to clients by the Alior Bank Group stood at PLN 32.7 billion and accepted deposits at PLN 35.8 billion at the end of March 2016. This represents an increase of 19 percent and 29 percent, respectively, year on year. The loan-to-deposit ratio was 91 percent.

• Alior Bank steadily improves its cost efficiency and grows the size of its business. The cost/income ratio (C/I) was 47.8 percent in Q1 2016.

• The capital adequacy ratios improved to 13.5 percent (CAR) and 10.6 percent (Tier 1) at the end of Q1 2016.

• On 31 March 2016, Alior Bank signed an agreement with the GE Capital Group to acquire a part of Bank BPH excluding the mortgage loan portfolio and BPH TFI. The deal is expected to be closed later in 2016. It will provide significant synergies enabling further improvement of the bank’s efficiency.

“The dynamic growth of volumes provides a robust foundation for improved profitability,” said Wojciech Sobieraj, President of Alior Bank. “In Q1 2016, our focus was to strengthen the market position, improve efficiency and sign the agreement to acquire a part of Bank BPH. We expect that the deal will be closed in Q4 2016 when all regulatory approvals are in place,” added Mr Sobieraj.

The total operating income of the Alior Bank Group stood at PLN 579 million in Q1 2016, up by 11 percent year on year. With the growing loan volumes, the net interest income grew by 20 percent to PLN 412 million. The net fee and commission income stood at PLN 87 million and the net trading and other income at PLN 80 million.

The Group is steadily improving its cost efficiency. The cost/income ratio (C/I) was 47.8 percent at the end of Q1 2016 (down by 1.9 percentage points year on year).

The volume of new loans granted by Alior Bank in Q1 was higher than in Q4 of the preceding year for the first time in history (up by 20 percent).

Loans granted to clients by the Alior Bank Group increased by 19 percent YoY to PLN 32.7 billion at the end of Q1 2016 while the volume of accepted deposits was PLN 35.8 billion, up by 29 percent year on year.

Alior Bank strengthened its capital base with an insurance bond granted by PZU on 31 March 2016 for a selected portfolio of the Bank’s credit debt, as well as two successful public issues of subordinated bonds worth PLN 220 million in aggregate. The capital adequacy ratios improved to 13.5 percent (CAR) and 10.6 percent (Tier 1) at the end of Q1 2016.

On 31 March 2016, Alior Bank signed an agreement with the GE Capital Group to acquire a part of Bank BPH excluding the mortgage loan portfolio and BPH TFI. Alior Bank is planning to raise money for the acquisition by issuing PLN 2.2 billion of stock with subscription rights of the existing shareholders. The prospectus has been submitted to the Polish Financial Supervision Authority (KNF) and the bank’s General Meeting has approved the stock issue programme. The acquisition of the core business of Bank BPH is conditional among others on the approval of the competent competition authority, as well as approvals and decisions of the Polish Financial Supervision Authority. The deal is expected to be closed later in 2016. It will provide significant synergies enabling further improvement of the bank’s efficiency. The combined assets of Alior Bank and Bank BPH will be ca. PLN 55 billion, ranking Alior Bank #9 in the Polish banking sector, as at 31 December 2015.

In Q1 2016, only five months after signing an agreement with the Romanian telecom operator Telekom Romania Mobile Communications, a member of the Deutsche Telekom Group, the National Bank of Romania registered Alior Bank’s branch as a foreign credit institution. This is an important step in continued development of the partnership and the first step of the bank’s international expansion. The Bank has been building up its partnership with T-Mobile on the Polish market as well.

Alior Bank is one of the fastest growing banks in Poland. Its assets stand at PLN 42 billion, ranking the bank #11 of Poland’s top banks by total assets at YE 2015. Nearly 3.1 million clients, including over 130 thousand companies, use the efficient service provided by more than 6,500 employees in the fourth biggest banking distribution network comprised of 831 outlets. Selected products and services of Alior Bank are offered in 583 T-Mobile points of sale under the companies’ strategic partnership, and in 71 Tesco stores. Since 2014, Alior Bank stock participates in the WIG20 index of the biggest and most liquid stocks listed on the Warsaw Stock Exchange (GPW).