- May 10, 2018

Alior Bank’s Financial Results Exceed Market Consensus

New loan production driven by strong organic growth largely exceeded the annual target in 2017 (PLN 6.9 billion v. PLN 5-6 billion) and Alior Bank moved from the ninth rank to being the eighth largest bank in Poland as measured by total assets.

“Q1 2018 was a period of focused efforts in attainment of strategic goals including the launch of the BANCOVO platform,” said Filip Gorczyca, Alior Bank’s Vice-President and CFO. “Our fast-growing financial results, which once again exceed the market consensus, corroborate the Bank’s increasingly solid market, capital, and liquidity position. This demonstrates that we are steadily building the Bank’s shareholder value,” said Mr Gorczyca.

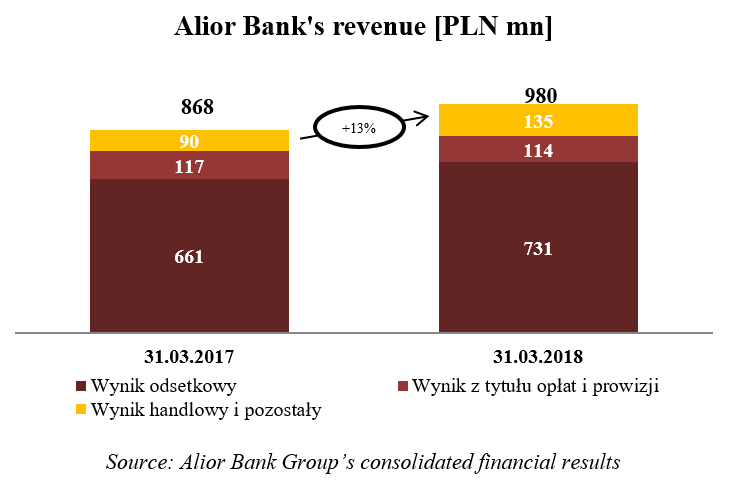

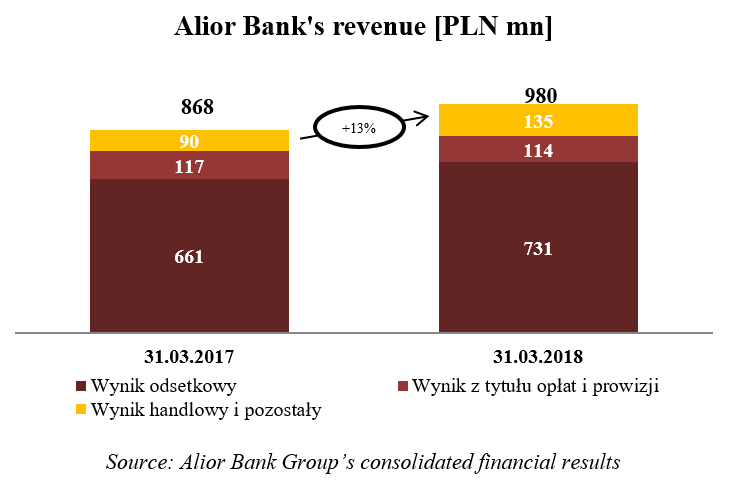

Alior Bank’s total operating revenue stood at PLN 980 million in Q1 2018, an increase of 13 percent year on year. Driven by the rising volumes of loans and advances, the net interest income rose by 11 percent to PLN 731 million.

The Bank maintained a high growth rate of gross loan volumes at PLN 1.4 billion in Q1 2018, which is in line with the annual sales guidance of PLN 5.5-6.5 billion. Alior Bank reported particularly high growth in the micro-firm segment and leasing, where sales increased by 29 percent and 14 percent quarter on quarter, respectively.

Customer deposits stood at PLN 59 billion at the end of Q1 2018 (an increase of 17 percent year on year) and the loan-to-deposit ratio was 87.4 percent. As a result, Alior Bank’s liquidity improved sharply as its LCR grew from 87% to 130% in the last three quarters. This was possible thanks to successful marketing campaigns aimed at the acquisition of customers in the bank’s strategic behavioural segments.

Alior Bank is steadily improving its cost efficiency. The cost/income ratio (C/I) was 46.8 percent at the end of Q1 2018 (down by 10 percentage points year on year), bringing the Bank close to its strategic target of 39 percent.

In Q1 2018, the Bank generated a return on equity (ROE) of 11.5 percent. As a result, ROE more than doubled year on year. The net interest margin (NIM) was 4.5 percent, which was close to the annual guidance of 4.6 percent in 2018.

Alior Bank is steadily improving its capital position, as well. TCR was 15.5 percent and the Tier 1 ratio was 12.2 percent as at the end of Q1 2018. The cost of risk (CoR) was lower than the original target and stood at 1.8 percent, close to the 2018 guidance. The Bank continues to improve customer service standards by investing in new digital solutions developed in accordance with the innovation methodology AGILOR. In early March, the Bank launched BANCOVO, the online credit platform that integrates the offering of banks and lenders. In the retail client segment, the digital channel generates growing sales. Sales of current accounts increased by 33 percent and loans by 22 percent year on year. The entire credit process is now available online.

In the business client segment, the bank has implemented a range of solutions to automate processes and speed up credit decision-making. For instance, Dronn is based on AI technology and supports the acquisition of micro-firms by contacting them by phone soon after the business is registered (180 companies were so acquired during the pilot). The Bank is developing its digital platform for businesses zafirmowani.pl and allows users of online accounting services to generate tax reporting files JPK.

The Bank released an upgrade of the new electronic (online and mobile) banking systems in mid-Q1 2018 and is planning further enhancements. As a result, the proportion of clients who are active in the mobile channel increased by 21 percent. The Bank has launched the application mobRATY which offers loans available on mobile devices. Close to 3.7k loans were sold through the application in Q1.

Alior Bank’s total operating revenue stood at PLN 980 million in Q1 2018, an increase of 13 percent year on year. Driven by the rising volumes of loans and advances, the net interest income rose by 11 percent to PLN 731 million.

The Bank maintained a high growth rate of gross loan volumes at PLN 1.4 billion in Q1 2018, which is in line with the annual sales guidance of PLN 5.5-6.5 billion. Alior Bank reported particularly high growth in the micro-firm segment and leasing, where sales increased by 29 percent and 14 percent quarter on quarter, respectively.

Customer deposits stood at PLN 59 billion at the end of Q1 2018 (an increase of 17 percent year on year) and the loan-to-deposit ratio was 87.4 percent. As a result, Alior Bank’s liquidity improved sharply as its LCR grew from 87% to 130% in the last three quarters. This was possible thanks to successful marketing campaigns aimed at the acquisition of customers in the bank’s strategic behavioural segments.

Alior Bank is steadily improving its cost efficiency. The cost/income ratio (C/I) was 46.8 percent at the end of Q1 2018 (down by 10 percentage points year on year), bringing the Bank close to its strategic target of 39 percent.

In Q1 2018, the Bank generated a return on equity (ROE) of 11.5 percent. As a result, ROE more than doubled year on year. The net interest margin (NIM) was 4.5 percent, which was close to the annual guidance of 4.6 percent in 2018.

Alior Bank is steadily improving its capital position, as well. TCR was 15.5 percent and the Tier 1 ratio was 12.2 percent as at the end of Q1 2018. The cost of risk (CoR) was lower than the original target and stood at 1.8 percent, close to the 2018 guidance. The Bank continues to improve customer service standards by investing in new digital solutions developed in accordance with the innovation methodology AGILOR. In early March, the Bank launched BANCOVO, the online credit platform that integrates the offering of banks and lenders. In the retail client segment, the digital channel generates growing sales. Sales of current accounts increased by 33 percent and loans by 22 percent year on year. The entire credit process is now available online.

In the business client segment, the bank has implemented a range of solutions to automate processes and speed up credit decision-making. For instance, Dronn is based on AI technology and supports the acquisition of micro-firms by contacting them by phone soon after the business is registered (180 companies were so acquired during the pilot). The Bank is developing its digital platform for businesses zafirmowani.pl and allows users of online accounting services to generate tax reporting files JPK.

The Bank released an upgrade of the new electronic (online and mobile) banking systems in mid-Q1 2018 and is planning further enhancements. As a result, the proportion of clients who are active in the mobile channel increased by 21 percent. The Bank has launched the application mobRATY which offers loans available on mobile devices. Close to 3.7k loans were sold through the application in Q1.